Compliance as a process is a topic often in the shadow of major news. However, identity checks are a critical part of doing business securely and reducing risk. For most businesses, when considering compliance, top of mind are painful implementations, time-consuming submissions, and costly administrative tasks.

ArriTech, launches QGen Online 2.0, the transformative risk management platform that leverages AI technologies such as document recognition and facial recognition to overall enhance security and streamline the efficiency of KYC for regulated industries. Extending across finance, real estate, gaming, crypto and other regulated industries.

QGen Online 2.0 serves a similar foundational role in risk compliance as a CRM does in Sales, overseeing a client’s entire lifecycle with an emphasis on simplicity and completeness.

For too long, consumers have faced the frustration of submitting a number of documents to securely complete identity checks. For businesses, the reviewing of these documents is even more challenging, especially where the risk of AI identity fraud is rapidly advancing and fake documentation easier than ever to reproduce.

QGen online is so impactful because businesses can now take advantage of a single advanced platform to manage compliance end-to-end, with a streamlined and innovative interface. The efficiency gains are significant, directly benefiting consumers by accelerating processing times, and reducing false positives to increase accuracy.

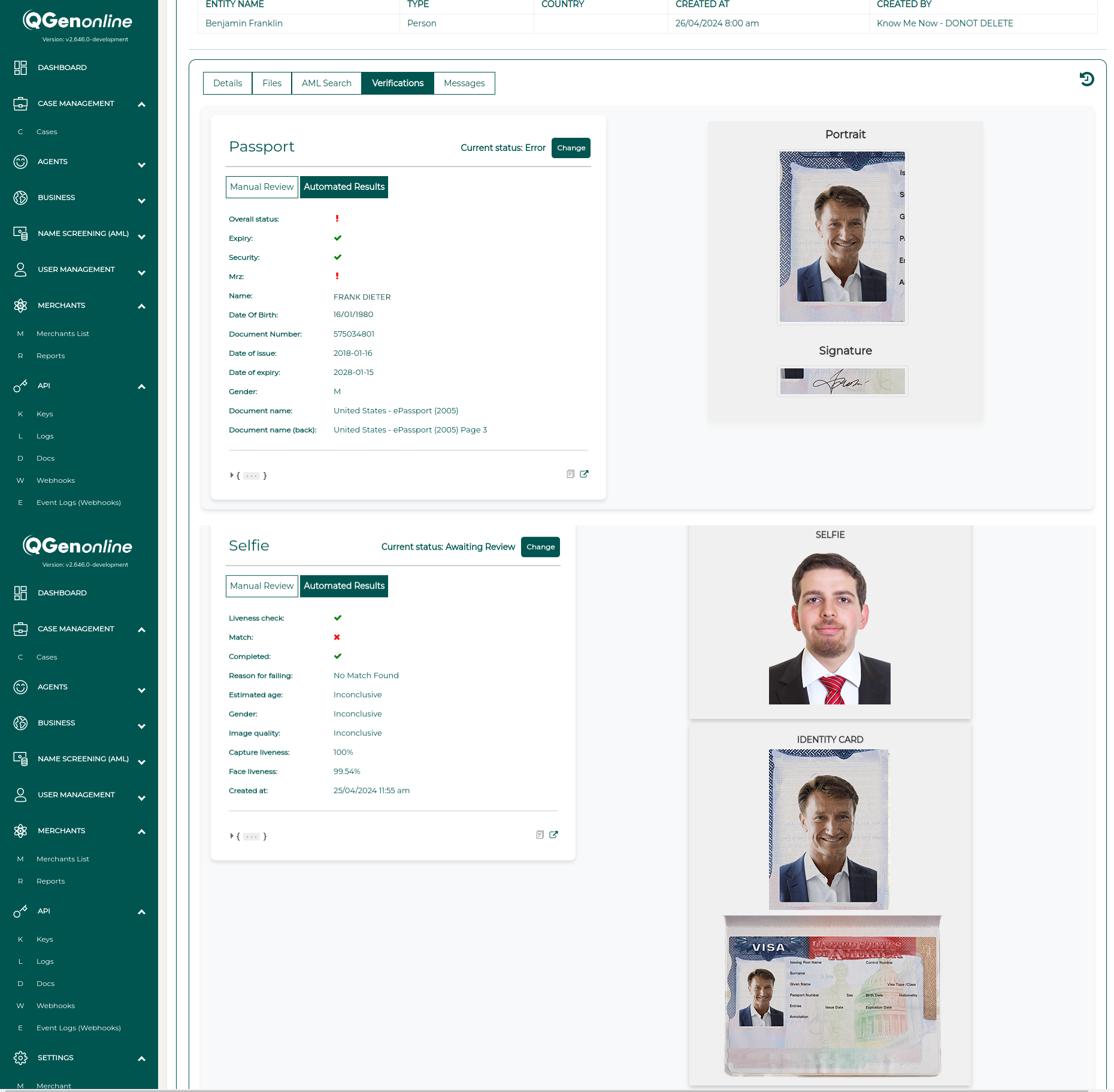

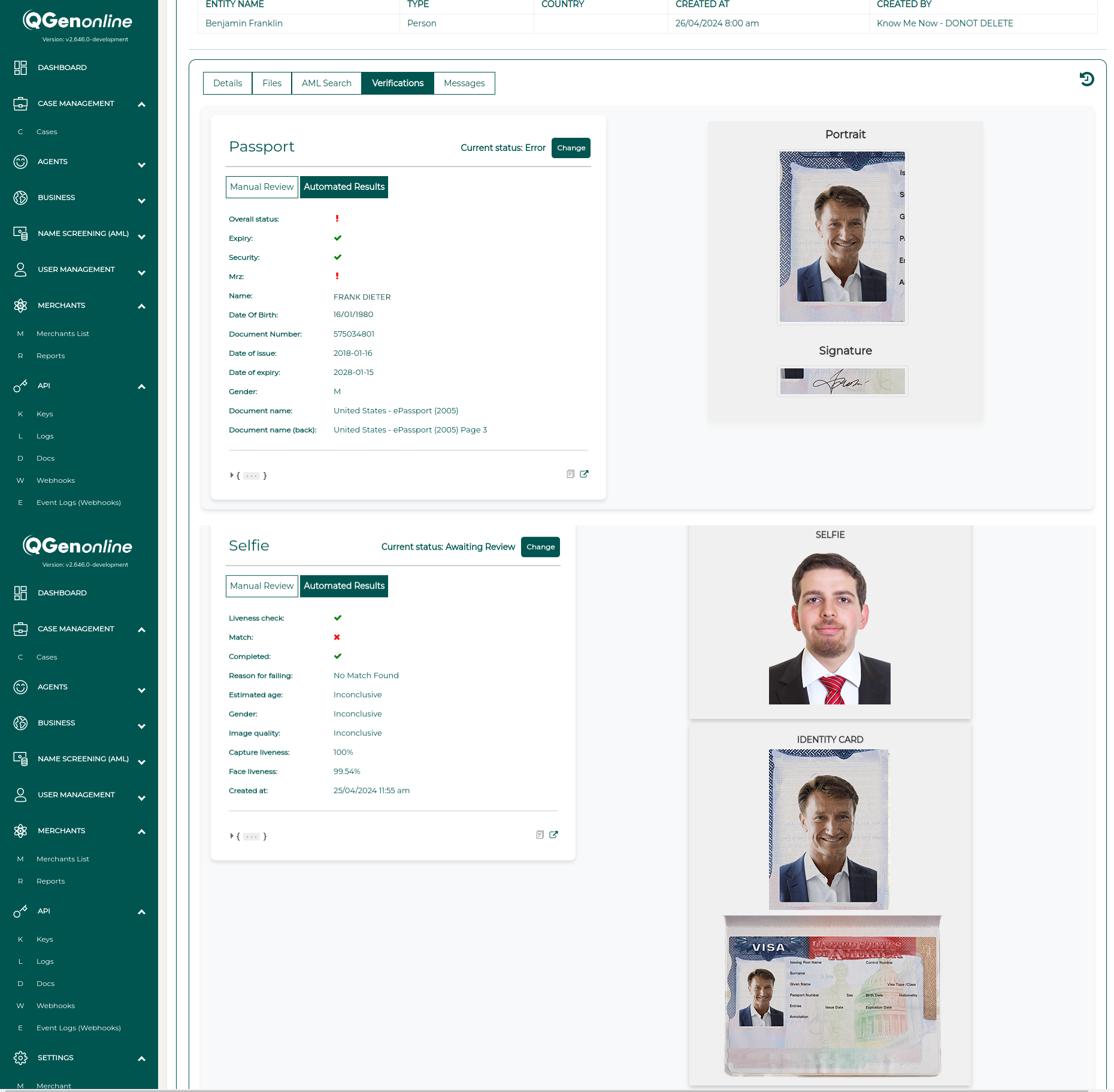

QGenOnline Platform Screenshot

Top Features

- Real Time Screening: Companies, UBOs, and directors for political exposure, adverse media, and more, effortlessly.

- AI Powered Features: Such as Liveness & Face Match, Lightening Fast KYC verification.

- CRM Style Client Management: End to end and seamless.

- Cloud-based: Be compliant instantly and verify customers within minutes without the need for further integrations.

- Optional API: Deeper integration possible with existing systems.

Top Benefits

- Effortless: Consolidate compliance tasks into one simple solution.

- Compliance Assured: Take comfort in robust auditing.

- Certified: Independently PAD Level 2 certified.

- Secure & Scalable: A trust solution from small to larger firms

- Enable efficient teamwork, with easy data sharing across departments.

- Drastically Reduce Costs: Through lower overheads, and reduced dependence on manual operations.

- Automated efficiency: Custom automations and workflows to reduce manual work & risks.

- Globally powerful: Available across multiple regions and regulatory frameworks.

Powerful Application

QGen Online extends powerfully across various aspects of risk management. By automating and integrating a wide variety of risk management processes, the platform significantly reduces the manual effort required in compliance tasks, thereby saving time and reducing costs. API integration allows seamless incorporation of any businesses existing systems, ensuring that companies can enhance their compliance strategies without disrupting current operations.

Automation

The true technological innovation powering QGen Online is in its comprehensive functionality and ease of use. For businesses dependent on manual KYC checks, screening, and record keeping, QGen offers significant time and cost savings, whilst minimising the risk of fraud.

Adrian Kreter, Founder of ArriTech, recently highlighted the need for such a platform. “We had tested various systems for our own portfolio companies; however, our requirements were increasingly complex. In 2021 we made the strategic decision to acquire and then develop our own purpose-built solution. Following years of development, and continual improvements based on real-time customer feedback QGen Online is now live and available externally! This platform is fully customisable and enhanced with AI to offer a best-in-class compliance." Adrian Kreter, Founder, ArriTech.

Learn More

With QGen Online, ArriTech not only simplifies compliance management but also empowers businesses to own their risk management lifecycle to a new higher standard. The platform is designed to support businesses in maintaining high compliance standards while focusing on their core operational growth.

Learn more at arritech.com